متابعة حالة بيان جمركي

Spinning

الخدمات الأكثر استخداما

اكتشف خدماتنا الذكية والمتنوعة التي تلبي احتياجاتك وتطلعاتك

نماذج العمل

نموذج إقرار وتعهد - مستندات تسجيل مورد أجنبي بمنصة كارجو أكس

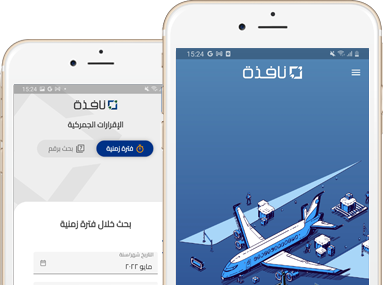

طلب تغيير المفوَّض على الحساب الرئيسي للمنشأة بمنصة نافذة

طلب إلحاق موظف على منشأة بمنصة نافذة

طلب إلغاء / إغلاق حساب فرعي لمعاملات الإلكترونية بمنشأة

أسئلة شائعة

المساعدة و الدعم

نحن متواجدون للرد عن استفساراتكم حول منتجاتنا وخدماتنا. تواصلوا معنا فنحن دائمًا في خدمتكم

مراكز نافذة

تفضل بزيارة احد مراكز نافذة .. واكتشف كل ما تهتم به

الأسئلة الأكثر تكرارا

قد قمنا بجمع الأسئلة الأكثر تكرارا من قبل عملائنا وتصنيفها إلى مجموعات

مركز الاتصال

اتصل على 15460، نحن متواجدين على مدار الساعة للرد علي تساؤلاتكم

البريد الالكتروني

تواصل معنا عبر خدمة البريد الإلكتروني للدعم والمساعدة